Makaleler

28

Tümü (28)

SCI-E, SSCI, AHCI (1)

SCI-E, SSCI, AHCI, ESCI (8)

ESCI (7)

Scopus (4)

TRDizin (11)

Diğer Yayınlar (10)

4. Is There Any Impact of the World Uncertainty Spillover Index (WUSI) on Firm Investment? Evidence from Turkey

Bingöl Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi (Online)

, cilt.7, sa.1, ss.97-108, 2023 (Hakemli Dergi)

5. DOES UNCERTAINTY AFFECT CORPORATE INVESTMENT DECISIONS? EVIDENCE FROM TURKISH FIRMS

Asian Academy of Management Journal of Accounting and Finance

, cilt.18, sa.2, ss.87-107, 2022 (ESCI)

13. The Impact of News about Pandemic on Borsa Istanbul during the COVID-19 Financial Turmoil

TURKIYE ILETISIM ARASTIRMALARI DERGISI-TURKISH REVIEW OF COMMUNICATION STUDIES

, cilt.0, sa.37, ss.109-124, 2021 (ESCI, TRDizin)

Hakemli Bilimsel Toplantılarda Yayımlanmış Bildiriler

13

Kitaplar

6

1. The Impact of Climate Policy Uncertainty on ESG Scores: Evidence from Latin American Countries

Sustainable Finance: Challenges, Opportunities and Future Prospects, Çatak Çiydem, Öner Mehtap, Editör, Peter Lang, Berlin, ss.59-75, 2023

Metrikler

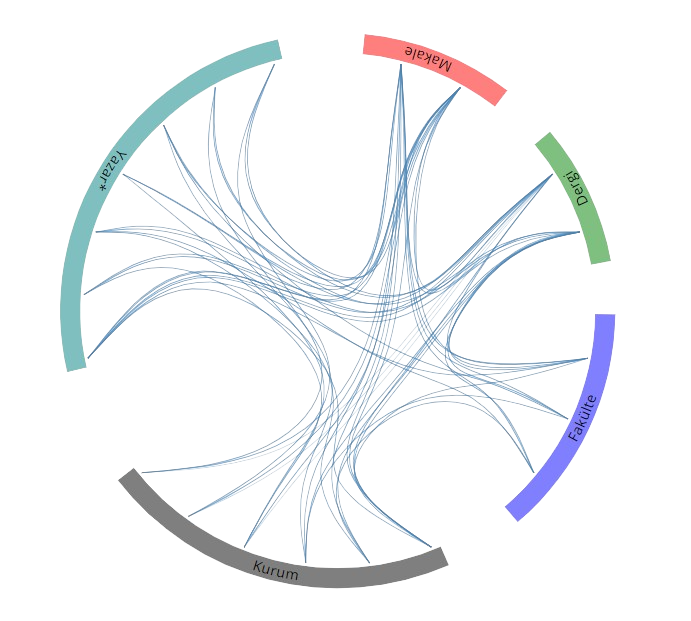

Yayın Ağı

Yayın Ağı