Makaleler

7

Tümü (7)

TRDizin (3)

Diğer Yayınlar (4)

3. CURRENCY UNION AND COMMENTS ON MACROECONOMIC INDICATORS OF EUROPEAN ECONOMIES AFTER EURO CRISIS

Review of Socio-Economic Perspectives

, cilt.3, sa.2, ss.165-181, 2018 (Hakemli Dergi)

4. Makroekonomik Gelişmeler

Vergici ve Muhasebeciyle Diyalog

, cilt.1, sa.1, ss.212-223, 2015 (Hakemsiz Dergi)

5. Küreselleşme Bağlamında Ulus Devletin Egemenlik Gücünün Dönüşümü

Sayıştay Dergisi

, sa.71, ss.23-29, 2008 (Hakemli Dergi)

6. Yolsuzluğun Ekonomik Büyümeye Etkileri Üzerine Teorik Bir İnceleme

Çimento İşverenleri Sendikası Dergisi,

, cilt.11, sa.4, ss.16-29, 2007 (Hakemli Dergi)

7. Devletin Fiyat İstikrarı Amacına Yönelik Bir Politika Olarak Enflasyon Hedeflemesi Yaklaşımı

İ.Ü. İktisat Fakültesi, Maliye Araştırma Merkezi Konferansları Dergisi

, sa.47, ss.253-272, 2005 (Hakemli Dergi)

Hakemli Bilimsel Toplantılarda Yayımlanmış Bildiriler

12

2. TAX COMPETITION: SHIFTING OF TAX BURDEN BETWEEN TAX BASES

MIRDEC-9th, International Academic Conference on Multidisciplinary and Independent Studies on Social Sciences, Rome, İtalya, 14 - 16 Ağustos 2018, ss.8, (Özet Bildiri)

5. TOURISM AS A TRIGGER FACTOR FOR ECONOMIC GROWTH IN TURKEY: COMMENTS ON POLICYCONSIDERATIONS

ITC’17 – 9th International Tourism Congres, The Image and Sustainability of Tourism Destinations, Lisbon, Portekiz, 29 - 30 Kasım 2017, ss.103, (Özet Bildiri)

6. What is Next in Tax Policy Reforms: Suggestions for Sound Tax Administration

Mirdec 5th VIENNA, Conference on Social Science, Multidisciplinary and European Studies, VIYANA, Avusturya, 12 - 14 Eylül 2017, ss.11, (Özet Bildiri)

7. Future of educational tourism: role of government on this new and appealing area

MIRDEC – 4th International Academic Conference Social Science, Multidisciplinary and Globalization Studies, Madrid, İspanya, 4 - 07 Temmuz 2017, ss.12, (Özet Bildiri)

8. Comments on Tourism Sector and Government Policies in Turkey

II. International Conference on Tourism Dynamics and Trends, Sevilla, İspanya, 26 - 29 Haziran 2017, ss.315, (Özet Bildiri)

10. Tax composition Revenue and Equality in European Union

International Journal of Arts & Sciences(IJAS) International Conference for Business and Economics, Freiburg, Almanya, 29 Kasım - 02 Aralık 2016, (Yayınlanmadı)

11. Comments on Government Budgets of European Countries after Monetary Union

IISES, 20th International Academic Conference, Madrid, 6 - 09 Ekim 2015, ss.34, (Özet Bildiri)

12. Global Trends in Corporate Income Tax Policy and Rates

CBU International Conference, Innovations in Science and Education, Praha, Çek Cumhuriyeti, 25 - 27 Mart 2015, ss.30, (Özet Bildiri)

Kitaplar

7

1. Sosyo-Ekonomik ve Mali Göstergeler Açısından Yeni Zelanda Üzerine Değerlendirmeler

Vergi ve Sosyoekonomik Göstergeler Çerçevesinde OECD, Öz Ersan, Mercan Altunakar Şehnaz, Buyrukoğlu Selçuk, Kutbay Hüseyin, Editör, Ekin Yayınevi, Bursa, ss.590-613, 2022

2. Financial Market Regulations in a Globalized World: Some Remarks for the MENA Region

Comparative Political and Economic Perspectives on the MENA Region, Erdoğdu Mustafa,Christiansen Bryan, Editör, IGI Global, Indiana, ss.180-198, 2015

3. Küresel Bir Sorun: E-Ticaretin Vergilendirilmesi ve Türkiye Örneği

Çevrimiçi Satış, Köktürk Sümersan Mehtap,Çobanoğlu Emine,Dirsehan Taşkın, Editör, Nobel Yayın Dağıtım, İstanbul, ss.163-174, 2015

4. Küresel Bir Sorun: E-Ticaretin Vergilendirilmesi ve Türkiye Örneği

Çevrimiçi Satış Bugünden Geleceğe Bir Potansiyel, Mehtap Sümersan, Köktürk. Çobanoğlu, Emine. Dirsehan,Taşkın. , Editör, Nobel, ss.163-174, 2015

7. Küreselleşme Bağlamında Vergi Rekabeti Üzerine Değerlendirmeler

Prof.Dr. Aytaç Eker, Yrd. Doç. Dr. Ayşegül Eker'e armağan, Kamil Tüğen; Mustafa Yaşar Tınar, Editör, Dokuz Eylül Yayınları, İzmir, ss.603-616, 2012

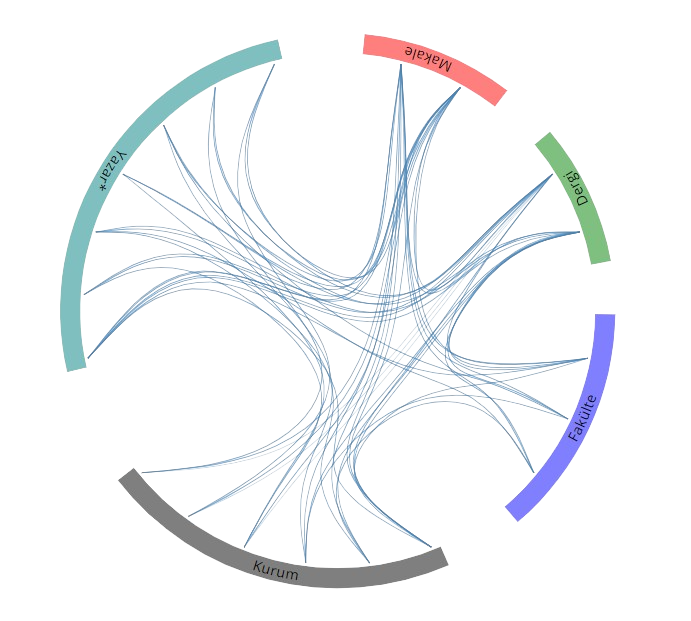

Yayın Ağı

Yayın Ağı