SCI, SSCI ve AHCI İndekslerine Giren Dergilerde Yayınlanan Makaleler

Diğer Dergilerde Yayınlanan Makaleler

Farklı Bir Özelleştirme Önerisi: Gayrimenkul Sermaye İradı Vergileme Sürecinin Özelleştirilmesi

Marmara Üniversitesi İktisadi ve İdari Bilimler Dergisi

, cilt.40, sa.1, ss.69-100, 2018 (Hakemli Dergi)

The Effect Of Foreign Direct Investment On Poverty Panel Regression Analysis For 40 Selected Underdeveloped And Developing Countries

Çukurova Üniversitesi Sosyal Bilimler Enstitüsü Dergisi

, cilt.21, sa.3, ss.225-240, 2012 (Hakemli Dergi)

The Effect of FDI on Foreign Trade: A Panel Analysis

Eskişehir Osmangazi Üniversitesi İktisadi ve İdari Bilimler Dergisi

, cilt.7, sa.1, ss.181-204, 2012 (Hakemli Dergi)

Kanada da KOBİ lere Yönelik Vergi Teşvikleri

Vergi Dünyası Dergisi

, sa.348, ss.124-130, 2010 (Hakemli Dergi)

Türkiye de Kamu Sosyal Transfer Harcamalarının Yoksulluğu Azaltmadaki Etkilerinin Ekonometrik Analizi

Maliye Dergisi

, sa.158, ss.326-348, 2010 (Hakemli Dergi)

Küçük ve Orta Ölçekli İşletmelere Yönelik Vergi Teşvik Politikaları Japonya ve Güney Kore Örnekleri

Marmara Üniversitesi İktisadi ve İdari Bilimler Dergisi

, cilt.25, sa.2, ss.385-404, 2008 (Hakemli Dergi)

İspanya da Küçük ve Orta Ölçekli İletmelere Yönelik Vergi Teşvik Politikası

Vergi Sorunları Dergisi

, sa.223, ss.109-119, 2007 (Hakemli Dergi)

Fransa da Küçük ve Orta Ölçekli İşletmelere Yönelik Vergi Teşvik Politikası

Ekonomik Yaklaşım

, sa.171, ss.218-223, 2007 (Hakemli Dergi)

Hakemli Kongre / Sempozyum Bildiri Kitaplarında Yer Alan Yayınlar

1980’Den Günümüze Hükümet Programlarında Kamu Bankaları Üzerinden Sunulan Finansal Vaatler

European Congress on Economic Issues - VI, Kocaeli, Türkiye, 14 - 15 Kasım 2019, ss.57-65

Hükümet Programlarındaki Özelleştirme Vaatleri: 1983-2018 Dönemlerindeki Hükümet Programları ve Özelleştirmeler Üzerinden Karşılaştırmalı Bir Analiz

European Congress on Economic Issues, Kocaeli, Türkiye, 14 - 15 Kasım 2019, ss.48-56

Sağlıkta Performansa Dayalı Ek Ücretlerin Hekimlerin Meslektaşlarıyla Arasındaki İlişkilerine Etkisi : İstanbul’daki Devlet Hastanelerinde Bir Araştırma

V. Strategic Public Management Symposium, İstanbul, Türkiye, 9 - 11 Ekim 2019, ss.392-399

Hasta-Hekim İlişkisi Yönüyle Hamilelik Sürecinde Bilgi Asimetrisine Etki Eden Faktörler: İstanbul’daki Hamile Kadınlar Üzerine Bir Araştırma

V. Strategic Public Management Symposium, İstanbul, Türkiye, 9 - 11 Ekim 2019, ss.385-391

Siyasi Partilerin Genel Seçim Beyannamelerindeki Kamu Yönetiminde Şeffaflık Vaatleri, 1990 – 2015

IV. Stratejik Kamu Yönetimi Sempozyumu, İstanbul, Türkiye, 18 - 19 Ekim 2018, ss.23-33

Is tax amnesties good for us all? Understanding influence of tax amnesties on between benefiters and non-benefiters

New Perspectives on Tax Administration Research, Munich, Almanya, 2 - 03 Kasım 2018

How tax amnesties affect tax compliance and fairnessperceptions of taxpayers: A case of Turkish Code 6736

26th Annual Tax Research Network Conference, Nottingham, Birleşik Krallık, 5 - 06 Eylül 2017

Understanding Influence of Tax Amnesties on Tax Compliance andFairness Perceptions of Taxpayers: The Example of Tax Code 6736

32nd International Public Finance Conference, Antalya, Türkiye, 10 - 14 Mayıs 2017, ss.77-80

Farklı Bir Özelleştirme Önerisi Vergileme Sürecinin Özelleştirilmesi Gayrimenkul Sermaye İradı Vergileme Sürecinin Özelleştirilmesi

13. Kamu Yönetimi Forumu, Selçuk Üniversitesi, Konya, Türkiye, 15 - 17 Ekim 2015

Great Depression 1929 in Istanbul and a Turkish Style Contribution to The Solution of The Crisis Sale Coupons

International Conference on Economic and Social Studies, Sarajevo, Bosna-Hersek, 10 - 11 Mayıs 2013

Doğrudan Yabancı Sermaye Yatırımlarının Dış Ticaret Üzerindeki Etkisi

1. Uluslararası Sinir Ticareti Kongresi, Kilis, Türkiye, 4 - 06 Kasım 2010

Doğrudan Yabancı Sermaye Yatırımlarının Yoksulluk Üzerindeki Etkisi

Turgut Özal Uluslararası Ekonomi ve Siyaset Kongresi–I, Malatya, Türkiye, 16 - 17 Nisan 2010

Türkiye de Kamu Sosyal Transfer Harcamalarının Yoksulluğu Azaltmadaki Etkilerinin Ekonometrik Analizi

24. Türkiye Maliye Sempozyumu, 19 – 23 Mayıs, Eskişehir Osmangazi Üniversitesi, Antalya, Türkiye, 19 - 23 Mayıs 2009

Tax Incentive Policy on Small and Medium Sized Enterprises in Japan and South Korea

International Scientific Dual Conference: "Towards Knowledge-Based Economy" & "Enterprise Management: Diagnostics, Strategy, Effectiveness, Riga, Letonya, 12 - 13 Nisan 2007

Tax Incentives for Research and Development Activities

International Scientific Dual Conference: "Towards Knowledge-Based Economy" & "Enterprise management: Diagnostics, Strategy, Effectiveness, Riga, Letonya, 12 - 13 Nisan 2007

Kitap & Kitap Bölümleri

İstanbul’un Sosyo- Ekonomik Yapısı Bakımından Vergi Göstergelerinin Analizi

Vergi ve Sosyoekonomik Göstergeler Çerçevesinde Türkiye, Ersan Öz, S. Şehnaz Altunakar Mercan, Selçuk Buyrukoğlu, Editör, Ekin Yayınevi, Bursa, ss.863-898, 2020

Teşvik Politikaları: Cumhuriyetten Günümüze Genel Bir Değerlendirme

Güncel Gelişmeler Perspektifinden Kamu Maliyesinde Seçme Konular, YILDIZ, Fazlı ve TUNCER, Güner, Editör, Savaş Yayınları, Ankara, ss.115-143, 2017

Understanding Influence of Tax Amnesties on Tax Complianceand Fairness Perceptions of Taxpayers

Issues in Public Sector Economics Empirical Analysisfrom Various Countries, Adnan Gerçek, Sacit Hadi Akdede, Editör, Peter Lang Publishing, Inc., Frankfurt, ss.121-140, 2017

Araştırma Geliştirme Faaliyetlerine Yönelik Teşvikler Karşılaştırmalı Bir Analiz

Ekin Yayınevi, Bursa, 2012

Ortadoğu ve Kuzey Afrika Ülkelerinde vergi sistemi ve politikası

Ortadoğu ve Kuzey Afrika Ülkelerinin Ekonomik Yapısı, Hamdi Genç ve Ferhat Sayım, Editör, MKM Yayınları, İstanbul, ss.243-281, 2011

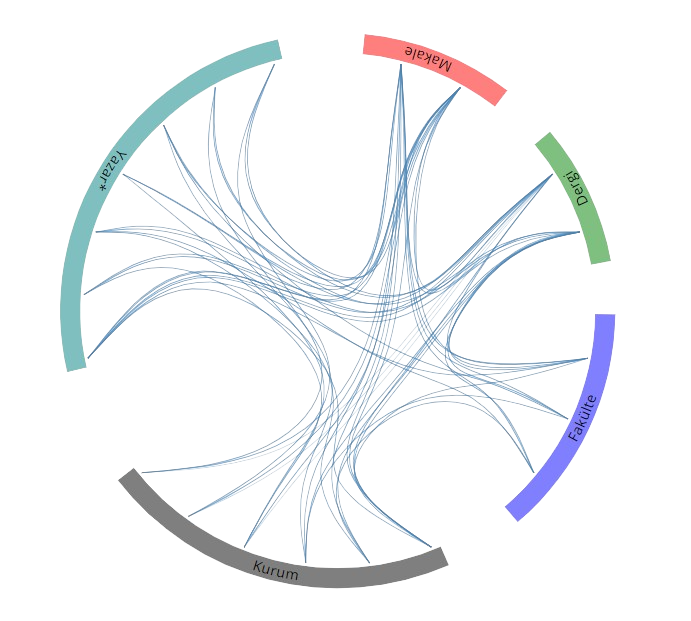

Yayın Ağı

Yayın Ağı