Makaleler

11

Tümü (11)

SCI-E, SSCI, AHCI, ESCI (1)

ESCI (1)

Scopus (1)

TRDizin (7)

Diğer Yayınlar (3)

1. Vergide Şeffaflık Gündemine Küresel Bir Bakış

Marmara Üniversitesi Hukuk Fakültesi Hukuk Araştırmaları Dergisi

, cilt.30, sa.2, ss.495-505, 2024 (Hakemli Dergi)

3. Turkish Judicial Approach to the Taxation of the Digital Economy

EUROPEAN TAXATION

, cilt.64, sa.2-3, ss.109-113, 2024 (Hakemsiz Dergi)

5. Recent Turkish Decision Finds that a WebsiteCan Constitute a Permanent Establishment

EUROPEAN TAXATION

, cilt.59, ss.135-137, 2019 (Hakemsiz Dergi)

6. Limitation of Benefits Clause and Turkey’s Approach: From Policy to Legal Order

INTERTAX

, cilt.45, sa.5, ss.417-426, 2017 (ESCI)

7. Yabancı HakemKararları UyarıncaÖdenen Tazminatlarınİndirilebilir GiderNiteliği Üzerine BirDeğerlendirme

Vergi Sorunları Dergisi

, sa.337, ss.39-51, 2016 (Hakemli Dergi)

8. Gelir Vergisi Kanunu Açısından İkale Sözleşmesi

Marmara Üniversitesi Hukuk Fakültesi Hukuk Araştırmaları Dergisi

, cilt.22, sa.2, ss.115-130, 2016 (Hakemli Dergi)

9. Transfer Fiyatlandırmasında Yabancı Emsal

Vergi Sorunları Dergisi

, sa.335, ss.81-101, 2016 (Hakemli Dergi)

10. Vergi Anlaşmalarının Aşımı Karşılaştırmalı İçtihat Örnekleri Üzerinden TürkHukukuna İlişkinÇıkarımlar

Vergi Sorunları Dergisi

, sa.331, ss.133-149, 2016 (Hakemli Dergi)

11. Mükellef Hakları Bildirgesinin Hukuki Niteliği

Vergi Dünyası

, sa.305, ss.184-194, 2007 (Hakemli Dergi)

Hakemli Bilimsel Toplantılarda Yayımlanmış Bildiriler

10

3. Mal Rejiminde Şirket Değerlerinin Tasfiyesinin Vergi Hukuku Anlamında Değerlendirilmesi

Yasal Mal Rejimi Sempozyumu, İstanbul, Türkiye, 19 - 20 Kasım 2022, ss.269-273, (Özet Bildiri)

6. Avrupa Birliği İçtihadı ve Türk İçtihadı Açısından Katma Değer Vergisinde Müteselsil Sorumluluk

Hukukta Sorumluluğa Güncel Yaklaşım, Türkiye, 14 Nisan 2017, cilt.5, ss.83-97, (Özet Bildiri)

7. BEPS Eylem 6: Vergi Anlaşmalarının Suistimalinin Önlenmesi

Vergilendirmede Matrah Aşındırma ve Kar Kaydırma, Türkiye, 27 Kasım 2015, (Tam Metin Bildiri)

8. Depicting National Tax Legislation: Turkey

Tax Legislation: Standards, Trends and Challenges, Lodz, Polonya, 10 - 12 Ekim 2013, ss.411-429, (Tam Metin Bildiri)

9. Vergi Anlaşmalarınd Gerçek Lehdar Kavramı

Genç Akademisyenler Yeni Yaklaşımlar, Türkiye, 14 Mayıs 2011, ss.145-167, (Tam Metin Bildiri)

10. National Report Turkey

The EU and Third Countries: Direct Taxation, Viyana, Avusturya, 13 - 14 Ekim 2006, ss.979-1000, (Tam Metin Bildiri)

Kitaplar

8

1. UZAY VE VERGİLENDİRME

On İki Levha, İstanbul, 2024

5. Çok Taraflı Vergi Anlaşmasının Temel Esasları

On İki Levha Yayıncılık, İstanbul, 2019

6. Chapter 35: Turkey

Implementing Key BEPS Actions: Where do we stand?, Michael Lang, Jeffrey Owens, Pasquale Pistone, Alexander Rust, Josef Schuch, Claus Staringer, Editör, IBFD, International Breau Fiscal Documentation, Amsterdam, ss.873-897, 2019

7. Vergi Anlaşmalarının Kötüye Kullanılması

On İki Levha Yayıncılık, İstanbul, 2016

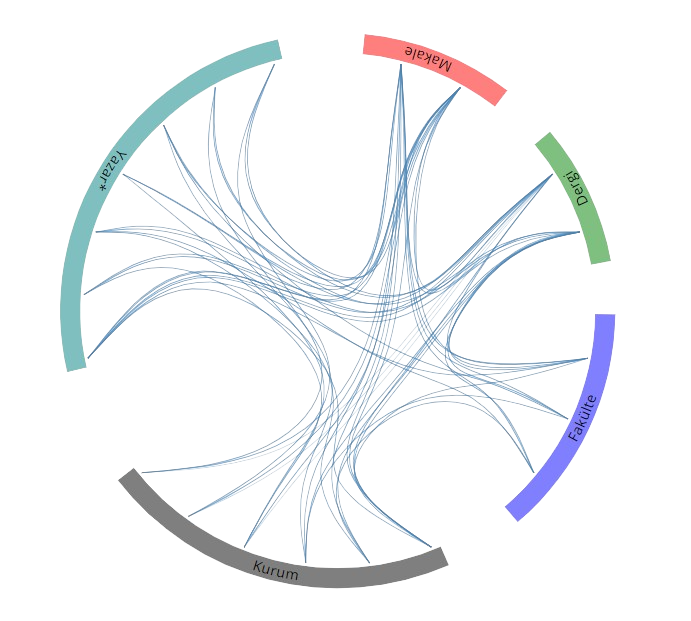

Yayın Ağı

Yayın Ağı